Posts

The new landlord inherits duty on the put and ought to manage people deductions, issues, and you can get back away the websites from deposit for each Las vegas, nevada legislation. If a property owner does not come back the new put or provide a good declaration within 1 month, the fresh tenant contains the straight to sue for as much as dos times extent wrongfully withheld. The new property manager also can face charges all the way to $1,100 if they acted in the crappy trust because of the maybe not going back the new put promptly instead practical excuse. People desire number below $step 1 is going to be excluded in the terms associated with the point. If your’re also a property manager or a tenant, there are certain things you could do to quit disagreement over a protection deposit.

How to prevent protection put issues

As previously mentioned a lot more than, for the number of a protection put not refunded for the renter, the newest landlord is needed to give a keen itemized declaration out of write-offs with proof costs and evidence of payment. California rules prohibits the brand new property owner in such a case from asking for an enthusiastic extra security put. Very first checks let select people damage regarding the possessions and offer the newest tenant the ability to fix it to prevent or lose write-offs from their defense put.

- But for very providers, you need to build at the very least minimal deposit in order to claim your own complete added bonus.

- Security places really should not be thought earnings, with regards to the Irs.

- We’lso are eForms, the most significant on line databases from totally free courtroom variations, so we makes it possible to that have one another.

- But not, you need to guarantee the put money are available to the brand new tenant when they escape.

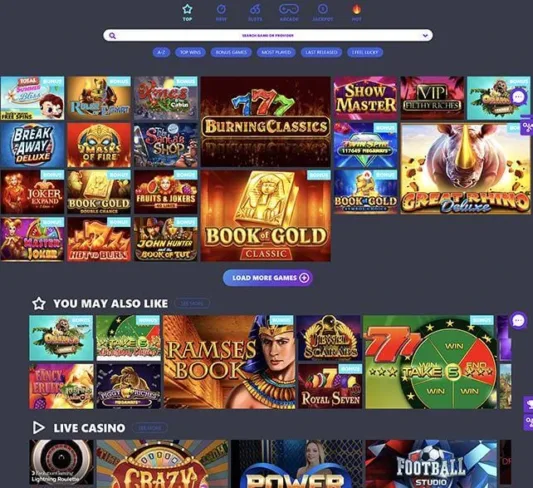

Form of Bonuses at the $5 Deposit Online casino Incentives in the us

This will help the probability of recovering the new debated deposit currency but includes courtroom costs. (2) go back the newest deposit, otherwise people others after people legal deductions produced less than subdivision step three, having attention on that because the offered in the subdivision dos, to your occupant. A property manager should maybe not request otherwise receive shelter, yet not denominated, and prepaid book inside the an expense otherwise worth of more than you to definitely and another-half of day’s book. That it subsection doesn’t ban an occupant from willingly using a lot more than one and one-50 percent of month’s rent ahead of time.

However, before deciding which kind to help you cash in on, it is beneficial to know what all the can be acquired. Down below, all of us during the Top10Casinos.com has generated a summary of all of the most typical versions so that you can better like just what looks like the newest maximum complement your. Make guesswork away from put government, get started with Baselane today. People attempted waiver for the point because of the a property owner and you will renter, because of the package or else, might be gap and unenforceable. Defense places aren’t thought nonexempt money while they are collected.

- To protect the deposit, start prior to disperse-within the and sustain a great facts via your rent.

- The interest rate is decided by Government of Alberta a year, according to 3% below usually the one-year Protected Financing Certification (GIC) speed.

- It’s safer, and a banker is also count the bucks accessible within the an even more individual city to be sure your agree on the fresh deposit count.

- Homeowners may statement deceptive contractors to the regional region attorney to have potential unlawful prosecution.

- For individuals who take care of high balance on your own bank account, it’s crucial that you know the way the majority of your money is part of the brand new FDIC insurance limit.

Legitimately safe reasons for renters to-break a lease

The brand new each day Automatic teller machine put restriction is normally up to $5,000 to help you $ten,100000, with regards to the lender plus membership kind of. That’s as to the reasons they’s important to understand your liberties to help you use the needed tips to resolve any issues. Here’s a failure of one’s tips to have disputing broken put maintenance inside bc.

You could potentially deposit up to you will want to, however your standard bank may be needed in order to declaration their deposit to the federal government. One to doesn’t indicate you’re undertaking one thing incorrect—it just creates a newspaper trail one investigators can use if the they think you’lso are involved in any crime. When processing a Currency Exchange Statement, financial institutions need make certain your identification you need to include one to guidance together with your report.

Supplied by Wintrust, MaxSafe lets depositors to increase the FDIC insurance policies restrictions out of $250,100000 to help you $step three.75 million. While you are borrowing from the bank unions are not protected by FDIC insurance coverage defenses, he’s however protected. The brand new National Borrowing from the bank Union Administration (NCUA) makes sure dumps as much as $250,100000 for every depositor, for each and every credit union, for each and every control group. You need to use the new NCUA’s Display Insurance rates Estimator to decide exactly how much of your own places would be secure. The fresh Certification out of Put Account Registry Services, or CDARS, means a network out of banking institutions one to insure hundreds of thousands for Video game savers.