Advanced Forex Trading Techniques for Success

In the fast-paced world of advanced forex trading Trading FX Broker and forex trading, mastering advanced techniques is vital for traders who aspire to elevate their trading game. While beginners often focus on basic strategies and tools, seasoned traders understand that it takes a comprehensive approach, a deep understanding of market dynamics, and a solid psychological framework to succeed. This article delves into various advanced forex trading strategies, risk management techniques, market analysis methods, and the importance of psychological discipline.

Understanding Market Dynamics

Enter the forex market with a clear understanding of its structure. The foreign exchange market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. Currency pairs, including major pairs (such as EUR/USD and GBP/USD), minor pairs, and exotic pairs, determine your trading opportunities. Knowledge of how these pairs move relative to each other is crucial for deploying advanced trading strategies.

Advanced Technical Analysis Techniques

Technical analysis remains a cornerstone of advanced forex trading. While basic chart patterns and indicators (like RSI and MACD) are foundational, traders must explore more sophisticated tools for effective analysis. Here are some advanced techniques:

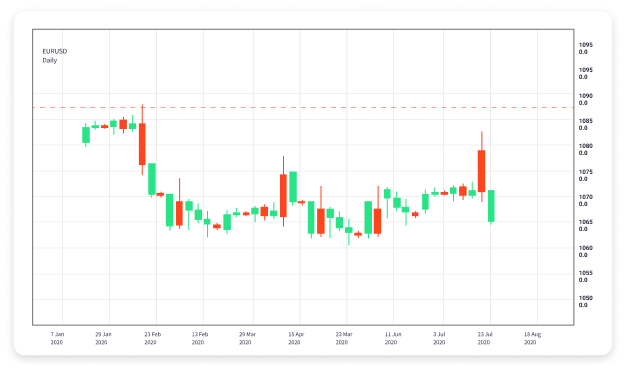

1. Candlestick Patterns and Price Action Trading

Understanding candlestick patterns is essential for forecasting market movement. Advanced traders focus on price action trading to identify potential reversals and trend continuations without relying heavily on indicators. Recognizing key formations, such as engulfing patterns, pin bars, and dojis, can give traders an edge in understanding market sentiment.

2. Fibonacci Retracement and Extension

Using Fibonacci retracement levels helps identify potential support and resistance zones. Advanced traders utilize not only the basic levels but also extensions for forecasting potential price targets. This technique involves measuring the price pullback before a continuation of the trend, aiding traders in making informed decisions.

3. Advanced Oscillator Techniques

While traditional oscillators such as the RSI and Stochastic are valuable, advanced traders may employ variations or utilize multiple oscillators in tandem to gauge overbought or oversold conditions accurately. Leveraging advanced divergence strategies can also help in confirming potential reversal signals.

Fundamental Analysis and Economic Indicators

Advanced trading strategies must integrate fundamental analysis. Understanding how economic announcements, geopolitical events, and central bank policies affect market sentiment is crucial. Key economic indicators such as interest rates, GDP, inflation, and employment statistics can provide insights into currency movements.

1. Economic Calendars

Traders should regularly consult economic calendars to stay informed about upcoming announcements that could impact market volatility. Knowing the expected outcomes and the previous figures helps traders make informed predictions about potential price movements.

2. Sentiment Analysis

Sentiment analysis involves gauging market sentiment through indicators like the Commitment of Traders (COT) report. Understanding whether the majority of traders are bullish or bearish on a currency pair can provide valuable context for making trading decisions.

Risk Management Strategies

Advanced trading is incomplete without robust risk management strategies. Protecting your capital is a priority for any successful trader. Here are advanced techniques to consider:

1. Position Sizing

Determining the right position size based on your account size, risk tolerance, and stop-loss levels is vital. Traders often use the Kelly Criterion or Fixed Fractional method to calculate appropriate position sizes, allowing for the maintenance of capital while optimizing growth potential.

2. Diversification

Diversifying across multiple currency pairs can mitigate risks associated with single trades. This involves trading different currency pairs or other asset classes to avoid being overly exposed to specific market movements.

3. Setting Stop-Loss and Take-Profit Levels

Advanced traders must implement precise stop-loss and take-profit levels based on technical analysis rather than arbitrary figures. This ensures that they are adhering to their trading plan while minimizing emotional decision-making.

Developing a Trading Plan

Creating a comprehensive trading plan that includes your trading goals, risk management rules, and entry/exit strategies is crucial for success. It should be a living document that evolves with your trading experience. Test your strategies through backtesting and demo trading before risking real capital.

Psychological Discipline in Trading

The psychological aspect of trading cannot be overstated. Advanced traders need strong emotional discipline to stick to their trading plans and strategies. Here are some practices to cultivate psychological resilience:

1. Keeping a Trading Journal

Maintaining a trading journal can provide insights into your decision-making processes, mistakes, and successes. Analyzing your trades helps in recognizing patterns in your behavior, enabling you to address psychological biases.

2. Mindfulness and Emotional Awareness

Practicing mindfulness techniques can help manage stress and improve decision-making. Understand your emotional triggers when trading and develop strategies to deal with them effectively.

Conclusion

Advanced forex trading requires a holistic approach that encompasses technical and fundamental analysis, robust risk management strategies, and strong psychological discipline. By acquiring a deeper understanding of the market dynamics and implementing the strategies outlined in this article, traders can significantly enhance their chances of success in the competitive landscape of forex trading. Continuous learning, adaptation, and discipline will mark the journey towards being a successful advanced forex trader.